Social Impact Bonds, or SIBs, are a financial product for funding outcome-based contracts in the public sector – in other words payment by results. The approach is increasingly popular in the charitable, local government and housing sectors. There are currently about 30 SIBs across the UK, many covering health and social care interventions. This number is likely to increase significantly because the government is trying to encourage the use of SIBs through the £80 million Life Chance Fund, managed by Big Lottery, which will help to pay for interventions that tackle some of the most difficult and costly social challenges.

How SIBs work

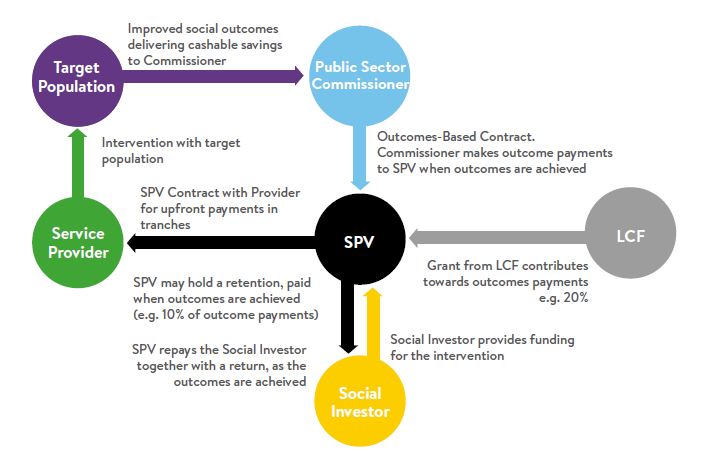

How does the process work and what are the challenges? Social investors fund the costs of an intervention made by a service provider and take the risk of the outcomes not being achieved. Where outcomes are achieved the public sector commissioner makes a payment for each outcome, including a return for the social investor.

The rationale for SIBs is that the outcome-based contract will deliver ‘cashable’ savings that will not only cover the costs of the SIB itself, but also result in year-on year savings to the commissioning body and sometimes the wider public sector. The SIB structure is intended to drive performance in achieving these outcomes and often involves setting up a Special Purpose Vehicle, as illustrated in the diagram (below).

SIBs are only appropriate for social interventions that fall into the ‘Goldilocks’ zone, where risks are not too high (hot) nor too low (cold) but ‘just right’. Social investors are reluctant to fund high-risk projects and, in any case, the costs of such investments would be prohibitive. Social investment for low-risk projects cannot be justified, as the public sector can fund these interventions at a lower cost.

Alternative methods

Payment by results (PbR) as a method of commissioning services is here to stay, but does not necessarily have to be delivered through a SIB. PbR contracts can be paid partially or even primarily on the outcomes achieved, which means some risk is transferred to the service provider. Commissioners therefore need to weigh up the risks and benefits of whether to deploy a PbR contract as a commissioned service or through a SIB.

A SIB can enable providers to have much greater freedom and flexibility in how they achieve the outcomes, as commissioners do not have to specify the services required – only the outcomes. Even PbR contracts that are funded through a commissioning budget require some level of service specification, as most of the funding is for a service (e.g. 90% of the funding paid up front in tranches and 10% on the achievement of outcomes). There have mixed reviews about whether SIBs work in practice, although there have been some positive results. The SIB in Peterborough was discontinued in 2015 due to the introduction of reforms in the probation service and the creation of Community Rehabilitation Companies (CRCs). The SIB had succeeded in reducing reoffending by 9%, against a Minstry of Justice target of 7.5% and gave investors a 3% per annum return.

A positive result

A recent evaluation of the London Homelessness SIB, for a cohort of 831 rough sleepers with complex needs, found the intervention significantly reduced rough sleeping over a two-year period and had a positive impact on the number of people moving into long-term accommodation. This was when compared with a well-matched comparison group

One commentator observed that:

The jury is still out. If they are well managed, with a reliable provider, SIBs offer the ability for councils to engage in complex, long-term projects that would otherwise be hard to fund. But for other social care projects, particularly those without a hard financial return, the additional cost and management overheads make them harder to justify.

Shaun Bennett is an Senior associate consultant for Campbell Tickell and was previously strategic commissioning manager at the Greater London Authority, responsible for commissioning the London Homelessness SIB.

To discuss the issues raised in this article, contact liz.zacharias@campbelltickell.com

This article also appeared in the CT Brief, Issue 33: Care & Support edition.